Find out the benefits of using self-billing invoices for businesses. You will also learn about the streamlined process, which is in compliance with the law, and desirable ways to increase bill accuracy and efficiency.

With the clamouring for the attention of small-scale businesses, finance directors, and freelancers, efficiently managing invoices is essential to maintain operations financially healthy. Amid various methods for invoicing, self-billing invoices are a vital tool for streamlining the payment process and ensuring that it conforms with tax and legal rules. This article will unravel the complexity of self-billing invoices and highlight the benefits, needs and perfect methods.

Introduction to Self-Billing Invoices

Self-billing invoices represent an arrangement between suppliers and clients in which clients create the invoice on behalf of suppliers on their own. Traditional billing methods provide greater ease in transactions while assuring invoices correspond with agreed-upon product/service delivery conditions. Self-billing invoices significantly ease the administrative burdens of businesses and freelancers who have to manage several customers or vendors.

Understanding Self-Billing Invoice Requirements

Respecting specific legal and regulatory rules is essential to implementing invoices for self-billing. Companies should warrant compliance with local tax laws that stipulate the information required to be included on every invoice. The information typically includes business names, addresses, tax identification numbers, an extensive description of any products or services offered, and the amount to be paid.

Benefits of Meeting Self-Billing Invoice Requirements

Businesses comply with laws and regulations by ensuring that self-billing invoices meet rules, reducing financial risk. Compliance invoicing systems enhance financial transparency, accuracy, and auditing procedures while strengthening credibility and professionalism by building trust between customers and vendors.

Critical Components of Self-Billing Invoice Requirements

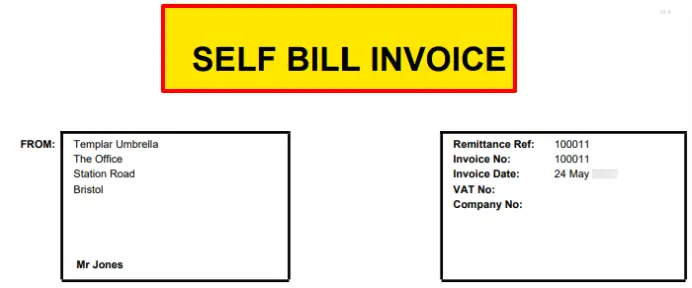

Self-billing invoices must contain crucial elements like the date, a unique invoice number, and an unmistakable identification of the invoice as self-billed. Accurately describing goods or services, quantity, and prices is vital to complying with and serving clarity during finance transactions.

Customizing Self-Billing Invoice Templates

Flexible invoice templates let companies incorporate brand images into their financial records. Incorporating company logos, colour schemes, and personal details improves the brand’s visibility and facilitates invoicing.

Legal Compliance in Self-Billing Invoice Templates

Ensuring that the invoices you create comply with the legal guidelines is unavoidable. Mandatory information, like the tax rate and payment terms, must be presented to avoid legal issues and assure transparency to clients.

Using Technology for Self-Billing Invoice Templates

Modern accounting software has powerful tools for creating, managing, and controlling auto-billing invoice templates. Automated functions can speed up the invoicing process, decrease the chance of errors, and integrate with more general accounting systems, improving efficiency in financial transactions.

Best Practices for Self-Billing Invoice Templates

Implementing desirable procedures in self-billing invoices means maintaining the integrity of data, regularly updating to keep up with changes in law, and reviewing the invoices regularly to identify and fix any errors. A practical employee training program regarding self-billing invoices could significantly enhance their effectiveness.

Case Studies: Successful Implementation of Self-Billing Invoice Templates

Small IT Services Company: A company has improved its financial transparency and efficiency by using self-billing invoices in its periodic services, thus reducing the billing process for its clients each month.

Independent Consultant: In the face of dynamic changes in tax laws, an independent consultant’s proactive strategy for billing invoices self-billing has resulted in a thorough audit trail, making it clear how important it is to adhere to the legal requirements.

FAQ’s

-

What exactly is a self-billing bill?

-

-

- Self-billing invoices allow buyers to easily create and distribute invoices to vendors on agreed-upon terms, streamlining billing processes.

-

-

What are the advantages of auto-billing invoices together?

-

-

- Self-billing invoices offer many advantages for buyers and suppliers alike, including time savings, reduced administration workload, more effective billing/payment procedures, streamlined processes for faster processing of invoices, and greater control of cash flow between them.

-

-

What is the process for self-billing? Operate?

-

-

- Self-billing refers to buyers creating and sending invoices directly to suppliers on terms agreed to between themselves, invoicing providers, and the law. Self-billing requires mutual understanding from both sides, specifically between supplier and buyer, regarding invoice details, payment conditions, and legal compliance issues.

-

-

What should you include in self-billing invoices?

-

-

- Self-billing invoices must include information such as the invoicing number and date, information on both parties involved in procuring services or goods and quantities, costs, payment terms, and discounts or taxes applicable—in other words; they must meet legal invoicing requirements.

-

-

What can companies do to warrant conformity with tax laws and legal regulations in the event of auto-billing invoices?

-

-

- Companies can warrant compliance by maintaining a precise record of self-billing transactions, complying with tax laws and regulations for invoicing, validating invoice information with suppliers using trustworthy accounting systems or software, and seeking skilled assistance.

-

-

What do you think are the desirable methods to set up auto-billing invoices?

-

-

- Good practices involve establishing explicit agreements with clients and suppliers, keeping accurate records, and ensuring secure and safe data integrity. Automate invoicing systems, perform regular audits and stay updated with legislative changes.

-

-

What can companies do to integrate auto-billing invoices into their system of accounting?

-

-

- Integration is possible with the right accounting software or any other system that supports self-billing. This enables seamless data exchange, reliable financial reports, and efficient invoice administration.

-

-

What will be the future developments or innovations in self-billing practice?

-

-

- In the future, invoice technology could advance through automated and AI advances, blockchain-based solutions to invoicing that bring greater security and transparency, and integration with payment systems that use digital technology to speed up transaction times.

-

-

Is self-billing appropriate for all kinds of companies?

-

- Self-billing may benefit numerous businesses, but its effectiveness depends on factors like the nature of transactions, the need for regulations, and the level of cooperation and trust between suppliers and buyers. Consultation with finance experts will help determine whether self-billing suits the specific company.

Conclusion

Adopting self-billing invoice templates optimised for efficiency will significantly improve effectiveness, compliance with the law, and transparency in financial transactions. Businesses can transform the icing by adopting the discussed needs, customisations, and desirable methods. Technological advancements are opening up new possibilities for self-billing, and they promise to simplify the process and encourage expansion for small-scale entrepreneurs, finance executives, and freelancers.

In the current business climate, changing and improving invoicing procedures is essential, which is a great way to gain an advantage. If properly understood and executed, self-billing invoices could be a valuable tool.